Mechanism

Timelock borrows tick liquidity from Uniswap V3 to create fully collateralized, leveraged positions for which traders are non-liable for losses and do not face liquidations.

How does it work?

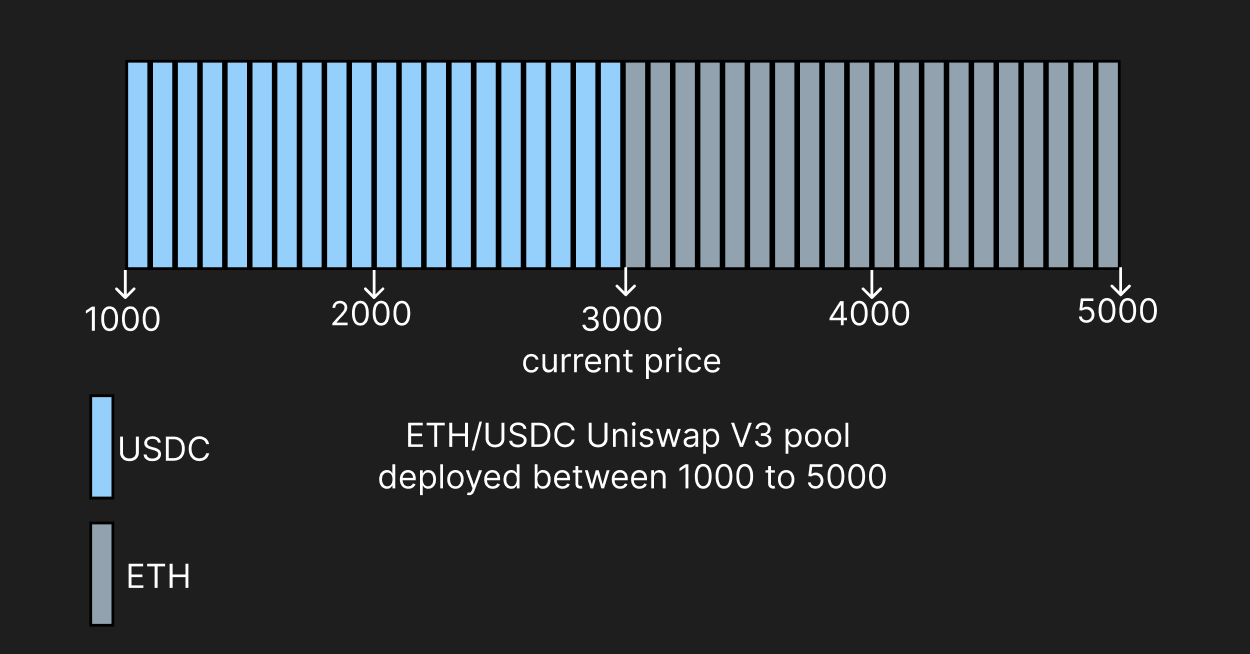

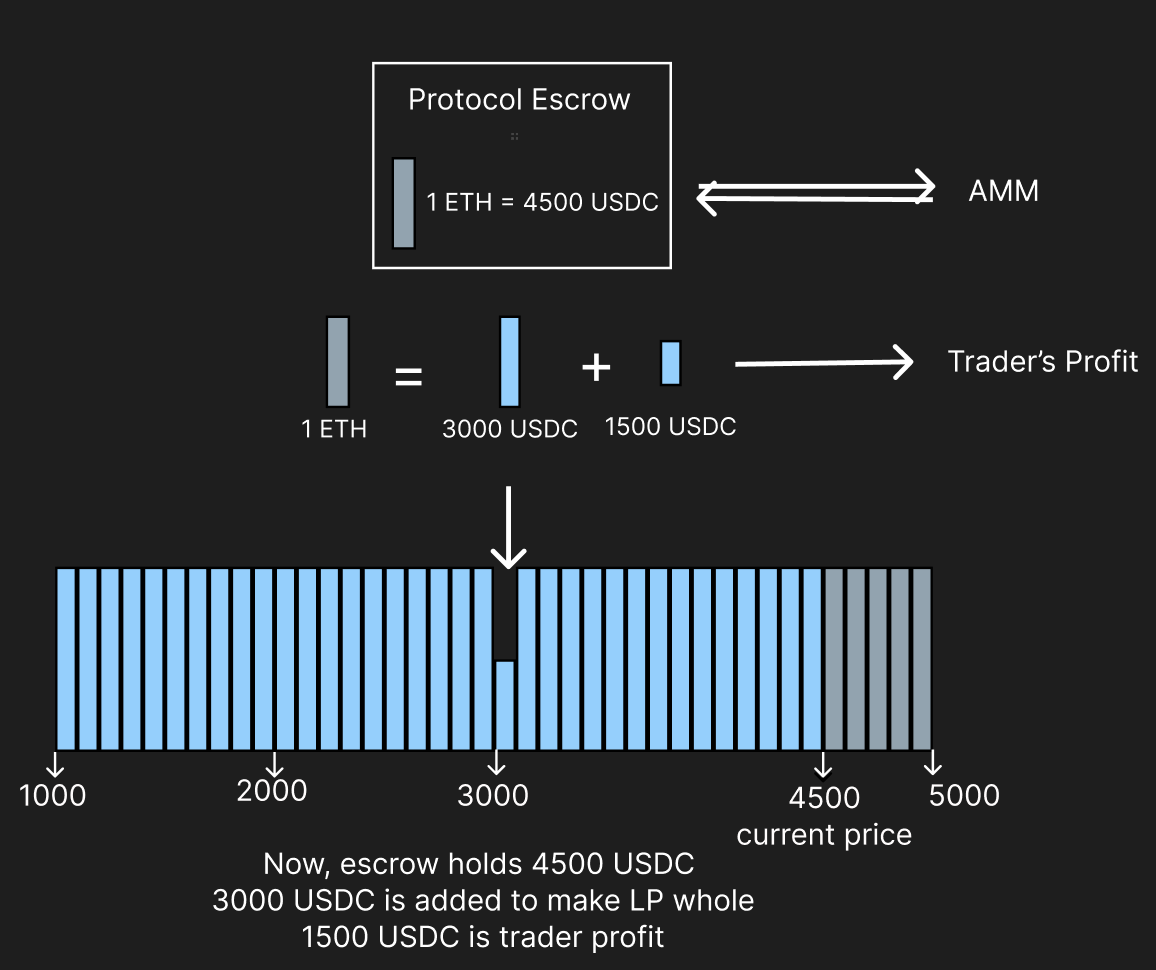

Let's take the example of an ETH/USDC Uniswap V3 pool when the price of ETH is 3000 USDC.

- All ticks below 3000 are entirely composed of USDC.

- All ticks above 3000 are entirely composed of ETH.

- There are 2 ETH per tick.

| Explanation | Visual |

|---|---|

| Pool Structure: The diagram shows how liquidity is distributed across different price ticks in the Uniswap V3 pool. Trader Payoffs: Trader makes a profit if ETH>3000 and no loss below it. |   |

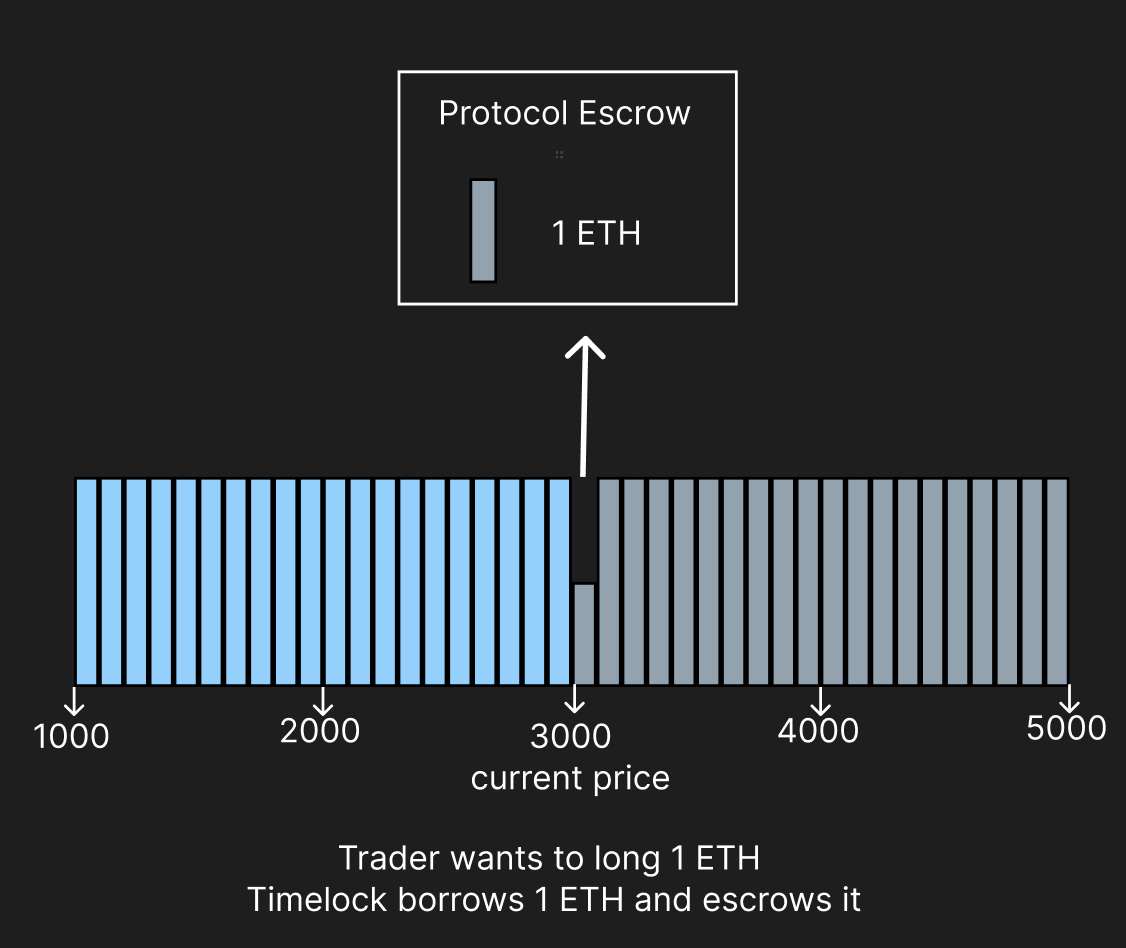

🚀 Trader Goes Long ETH

| Process | Setup |

|---|---|

| Step-by-step process: 1. Trader expresses intent to long 1 ETH No-Loss Perp and deposits margin 2. Timelock borrows 1 ETH from the next tick and escrows it outside the pool 3. Trade position is opened and funding payments are deducted from trader margin |  |

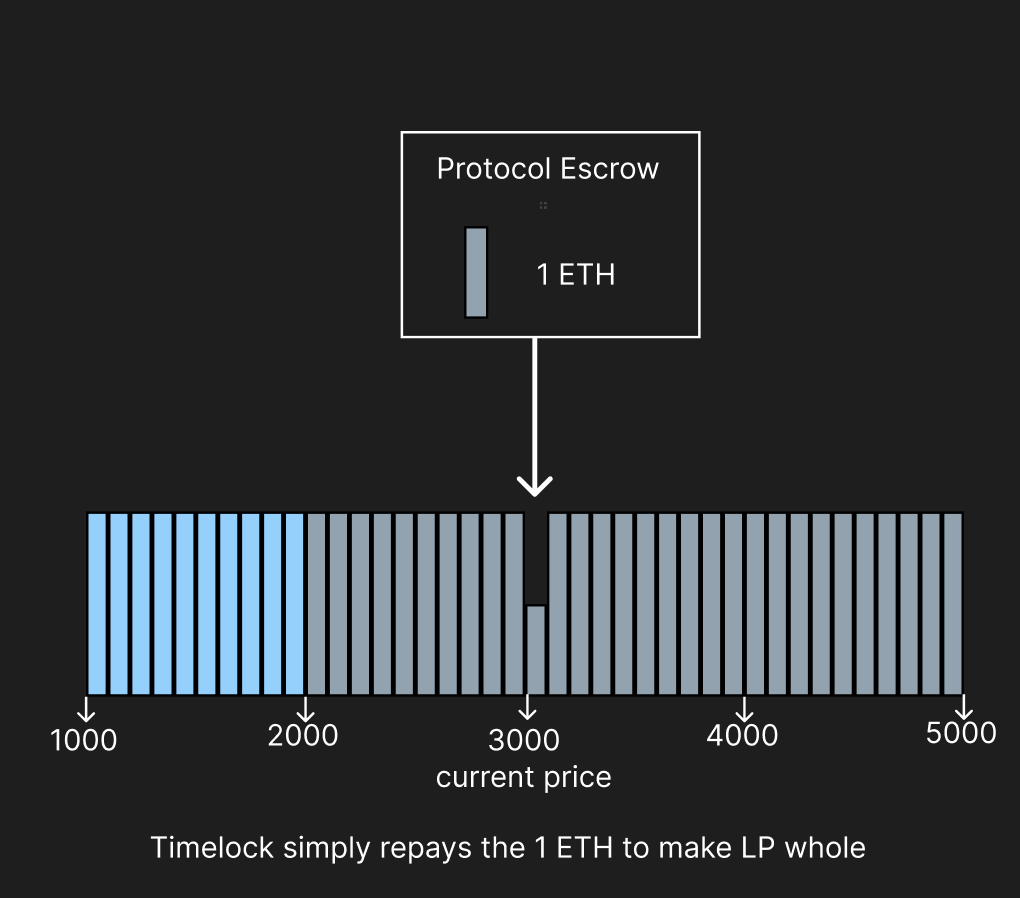

📉 Scenario: ETH Goes Down

| Scenario | Protection |

|---|---|

| Example: Price of ETH goes down to 2000 USDC What happens: - Timelock simply repays back the 1 ETH held in escrow to make the LP whole - No losses for the trader - this is the "no-loss" guarantee! |  |

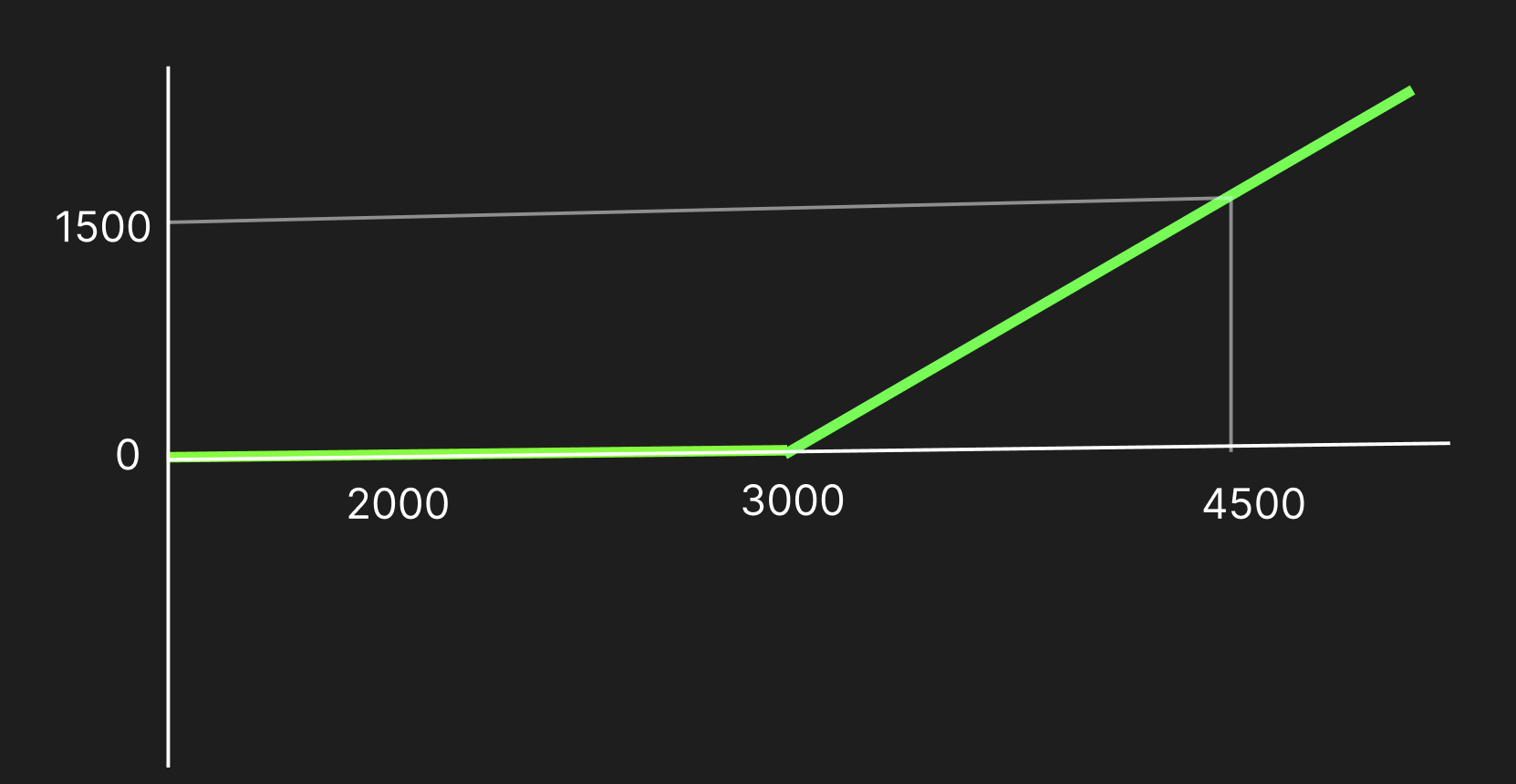

📈 Scenario: ETH Goes Up

| Scenario | Profit |

|---|---|

| Example: Price of ETH goes up to 4500 USDC What happens: 1. Value of 1 ETH in escrow is 4500 USDC 2. Timelock swaps 1 ETH for 4500 USDC 3. Repays 3000 USDC to the LP to make them whole 4. Remaining 1500 USDC is the trader profit! 🎉 |  |