Timelock Mechanism

Timelock Trade operates on a sophisticated mechanism that leverages Uniswap V3's concentrated liquidity to create unique trading opportunities. Here's how the entire system works from start to finish.

Core Concept

Timelock Trade borrows idle tick liquidity from Uniswap V3 LPs and uses it to create fully collateralized, leveraged positions for traders. The key innovation is that LPs remain risk-neutral while traders gain access to unprecedented leverage without liquidation risk.

The Process

1. Liquidity Deposits

- LPs deposit USDC into Timelock vaults

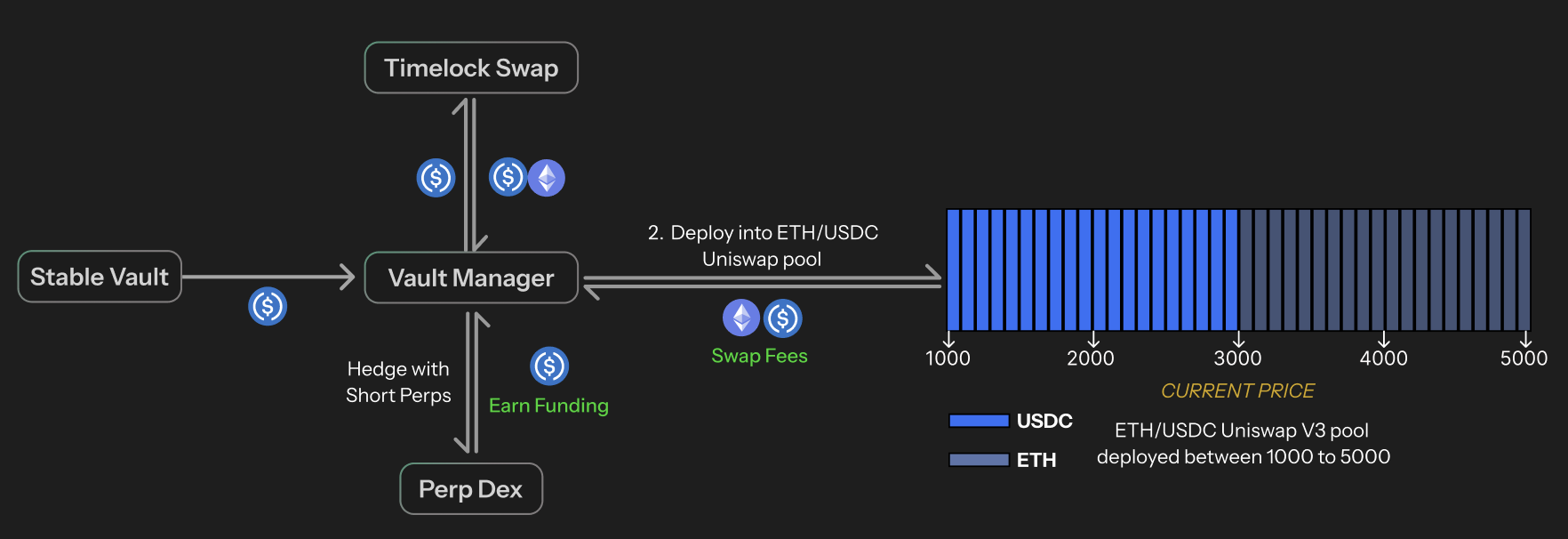

2. Vault Deployment

- Vault managers provide liquidity on Uniswap V3 within specific price ranges.

- They hedge Uniswap V3 exposure by taking short positions on perpetual DEXs.

- Actively manage, rebalance liquidity ranges and perpetual short positions.

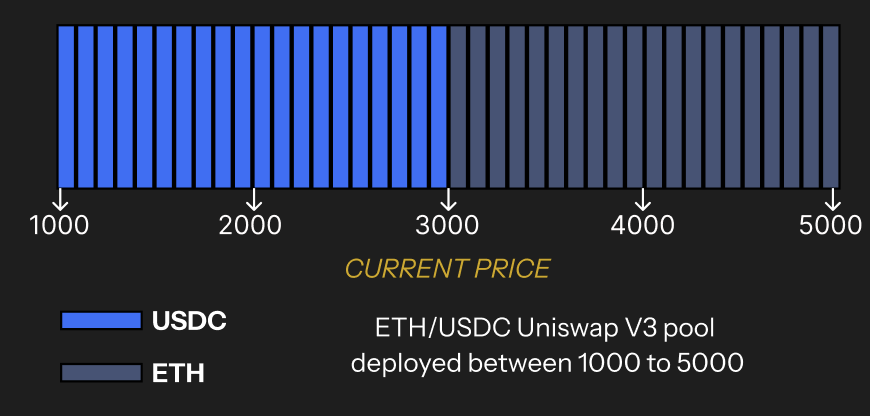

In Uniswap V3, liquidity is concentrated within specific price ranges:

Price Range: [Pₐ, Pᵦ]

Current Price: Pₜ

If Pₜ < Pₐ: Tick contains only token1 (USDC)

If > Pᵦ: Tick contains only token0 (ETH)

If Pₐ ≤ Pₜ ≤ Pᵦ: Tick contains mix of both tokens

Let's take the example of a ETH/USDC 0.05% Uniswap V3 pool with:

- Pₐ=1000

- Pᵦ=5000

- Pₜ=3000

| Visualisation | |

|---|---|

| Pool Structure: The diagram shows how liquidity is distributed across different price ticks in the Uniswap V3 pool. |  |

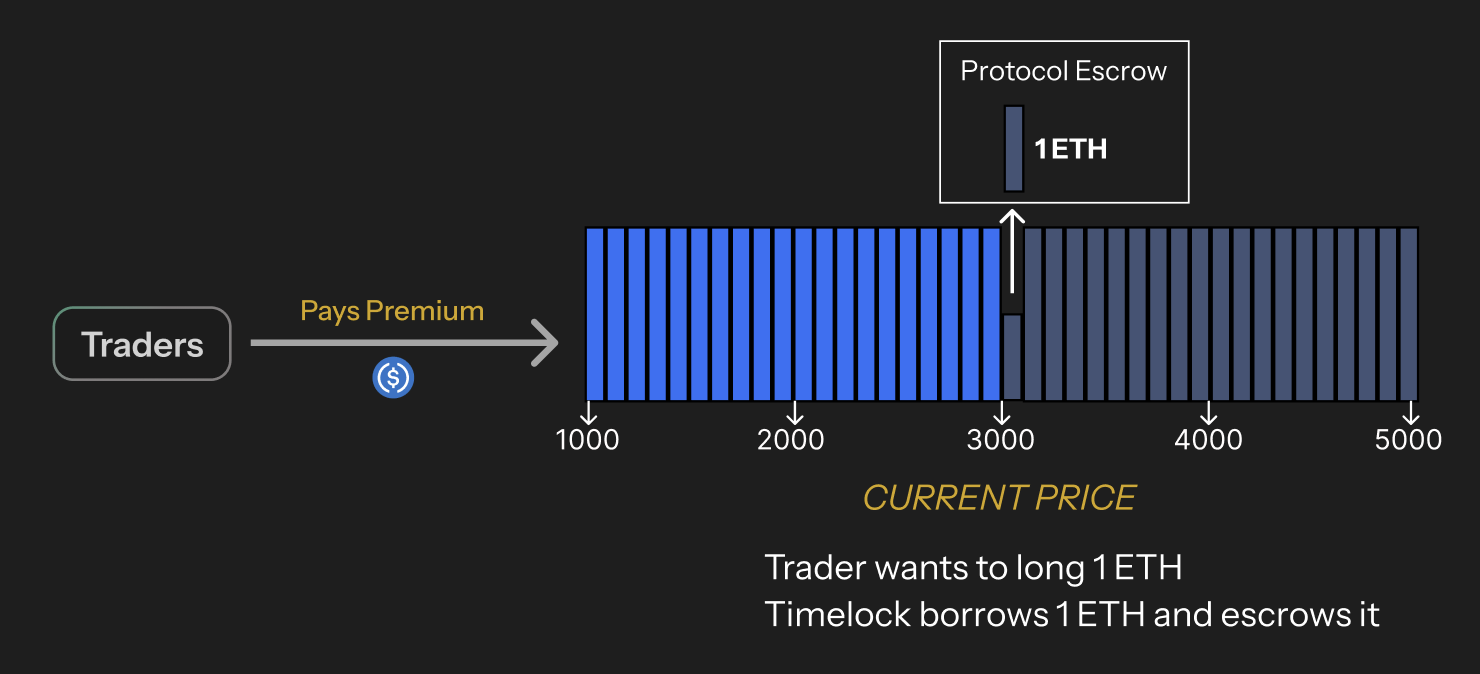

3. Trader Goes Long ETH

- Trader expresses chooses to LONG 1 ETH for 1 hour.

- Timelock calculates trader needs to pay $10 premium.

- Trader pays $10 premium and enters the trade.

| Process | Setup |

|---|---|

| Timelock borrows 1 ETH from the next tick and escrows it outside the pool. |  |

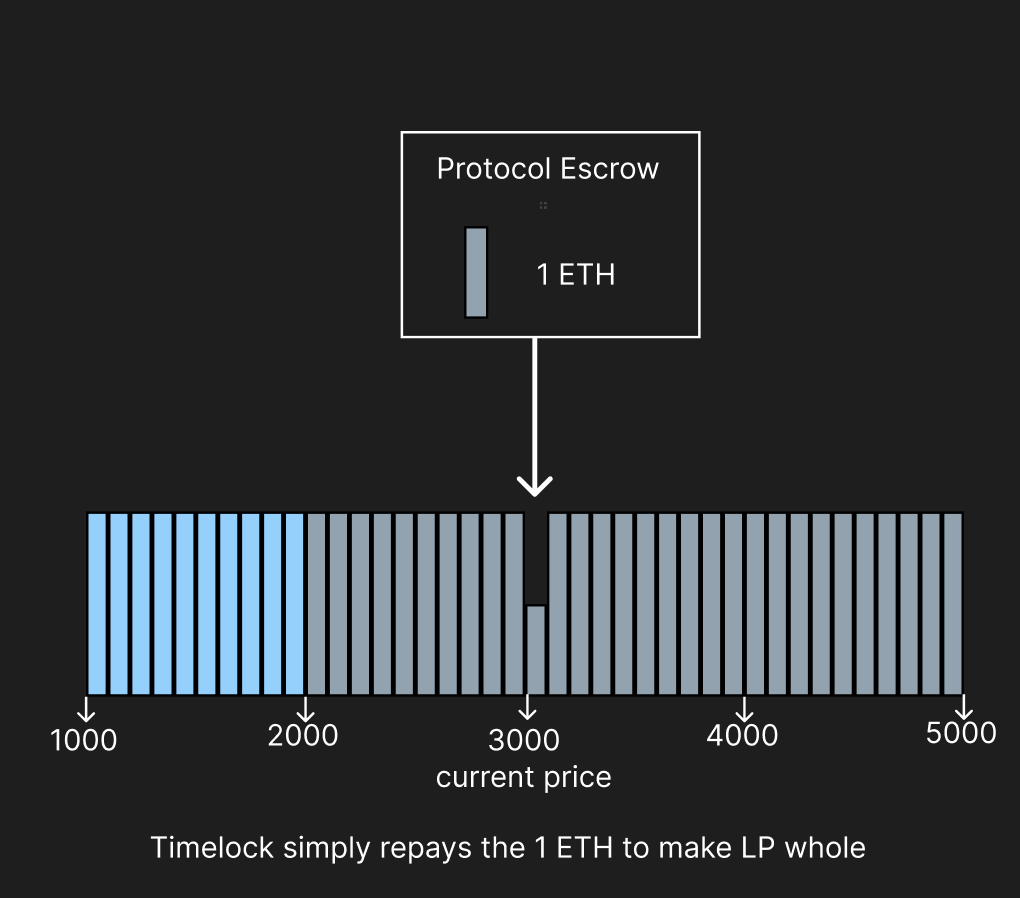

4A. ETH Goes Down

- Let's say, the price of ETH goes to 2000 USDC.

- Trader would have faced a loss of 2000 USDC or gotten liquidated on another platform..

- But on Timelock, they only lose $10 and their trade is closed.

| Scenario | Protection |

|---|---|

| Timelock simply repays back the 1 ETH held in escrow to make the LP whole. |  |

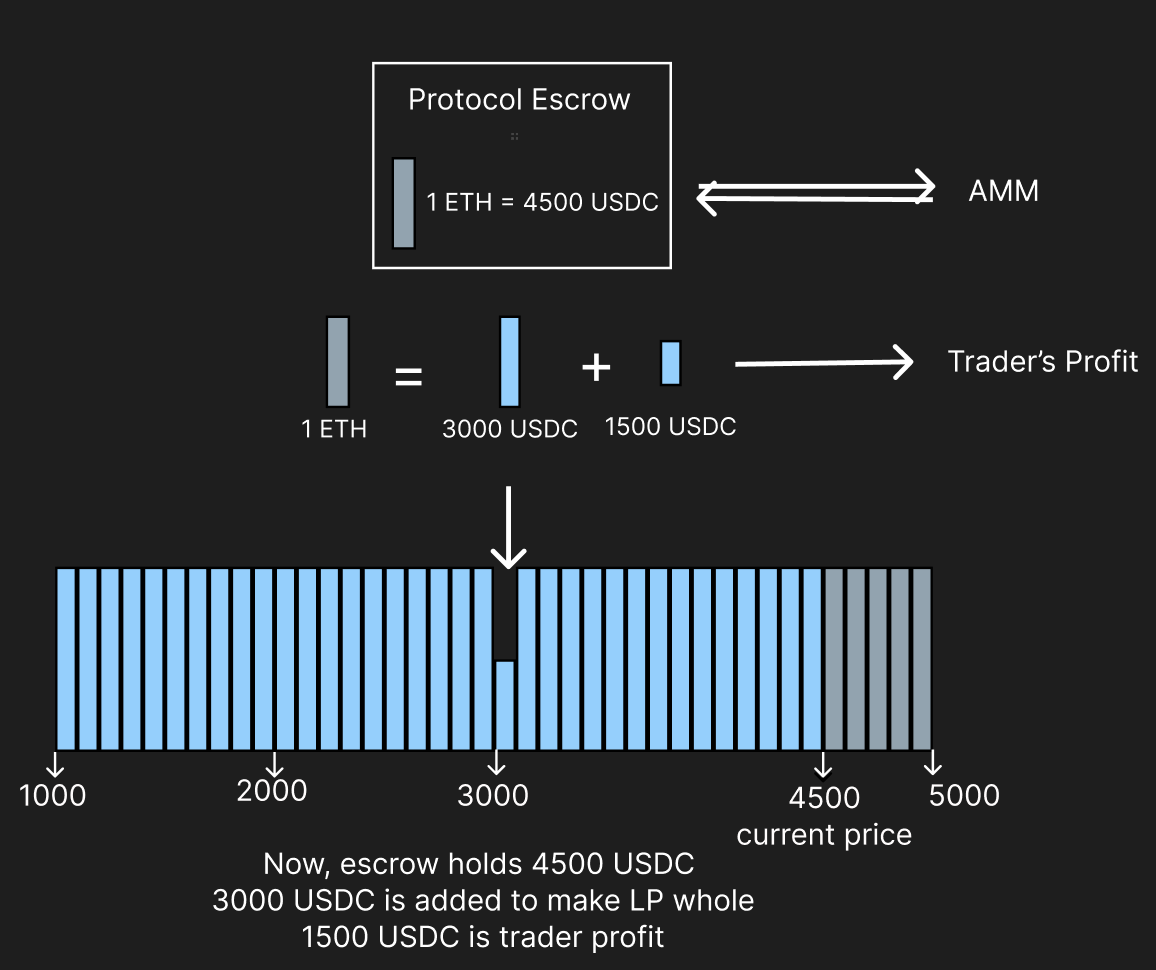

4B. ETH Goes Up

- Let's say, the price of ETH goes to 4500 USDC.

- Trader makes the entire upside of $1500 as they would have made on any other platform.

| Scenario | Profit |

|---|---|

| 1. Value of 1 ETH in escrow is 4500 USDC. 2. Timelock swaps 1 ETH for 4500 USDC. 3. Repays 3000 USDC to LP to make them whole. 4. 1500 is trader profit. |  |