Liquidity Provision

Liquidity providers can easily participate by making a simple 1-click USDC deposit into managed LP vaults.

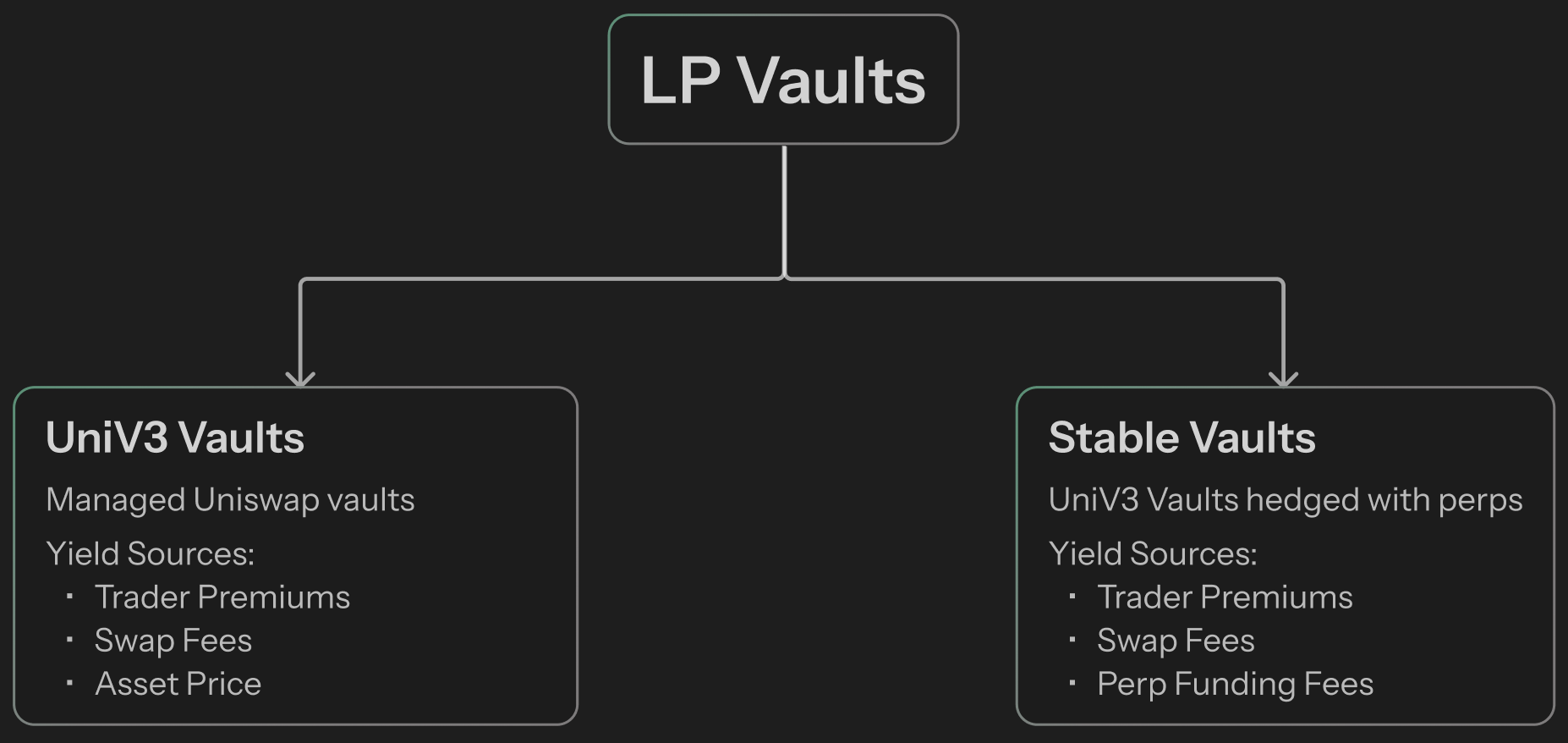

Timelock offers two types of vaults tailored to different risk preferences:

- UniV3 Vaults: For LPs bullish on specific assets, these vaults capture the upside by deploying liquidity within Uniswap V3, benefiting from price appreciation alongside fees.

- Stable Vaults: Designed for LPs seeking delta-neutral exposure, these vaults provide stablecoin yields independent of underlying asset price movements.

Vaults are actively managed to optimize returns, automate range rebalancing, and compound earned fees, simplifying the LP experience while maintaining risk neutrality.

Vault Managers

Timelock-managed vaults:

- Official protocol strategies with conservative risk profiles and proven, back-tested performance.

- Transparent fee structures and publicly available performance metrics.

- Designed to optimize liquidity provision with automated range selection and management.

Whitelisted market makers:

- White-listed market makers delivering professional market-making strategies from experienced traders and firms such as RE7, MEV Capital, and STS Digital.

- Employ sophisticated techniques with advanced risk management and hedging to maximize yield potential.

- Utilize a performance-based fee structure aligned with vault success.

User-managed vaults:

- Self-directed strategies granting LPs full control over tick allocation and rebalance timings.

- Ability to set custom risk parameters tailored to individual preferences.

- LPs bear direct responsibility for their strategy’s performance and outcomes.

LP Guarantee

In Timelock, every trader position is inherently fully collateralized, ensuring that the position’s value always meets or exceeds the debt owed to liquidity providers.

This design guarantees that LPs incur zero risk of loss, setting Timelock apart from other lending markets that depend on liquidations or forced closures. Safety is a foundational principle embedded at the core of the protocol.

How LPs Make Money

Deposited liquidity value appreciates from 3 sources:

- Trader Fees: Traders pay a premium to the LPs for borrowing idle tick liquidity.

- Uniswap Swap Fees: Swap fees are earned for every swap and auto compounded.

- Yield Optimization: Strategic deployment & active rebalancing for maximum returns.

Getting Started as an LP

Ready to Start?

Choose a vault that matches your risk profile

Deposit assets (ETH, USDC, or other supported tokens)

Earn premiums from trader positions automatically

Monitor performance through the dashboard

Withdraw when needed (subject to liquidity availability)