Pricing Model & Implied Volatility

This section presents the mathematical framework for pricing Timelock positions by equating option premia with liquidity provider fee collection, ultimately deriving implied volatility from Uniswap market data.

Pricing Mechanisms Overview

Pricing can be implemented using multiple approaches:

- Standard Black Scholes Model Option Price - taking IV off-chain and price on-chain

- Standard Black Scholes Model Option Price - taking IV and price both derived from the pool

- Multiple of Swap fees forward calculated - not timed

- Borrowing Rate forward calculated - not timed

Premium Pricing

This is a new derivative which does not have a predefined pricing mechanism. However, it bears close resemblance to an ATM call long or a future long+ put position.

Standard Black-Scholes-Merton Model

The standard pricing mechanism for a call option is given by the Black-Scholes-Merton model as:

Where:

Parameters:

- = call option price

- = CDF of the normal distribution

- = spot price of an asset

- = strike price

- = risk-free interest rate

- = time to maturity

- = volatility of the asset

ATM Call Option Adaptation

In an ATM call option, , so and become:

The pricing formula becomes:

Crypto Asset Adaptation (r = 0)

For crypto assets, we use risk-free rate , so the formula simplifies to:

For and with :

Final simplified formula:

This simplified formula eliminates the complexity of interest rate calculations while maintaining the core pricing mechanics for decentralized finance applications.

Pool Utilization Optimization

We introduce optimization that accounts for pool utilization to accurately reflect market dynamics. This approach is inspired by peer-to-pool mechanism protocols, most notably AAVE.

Utilization Rate Definition

Where:

- = utilization rate of the pool

- = variable rate parameter (optimal utilization threshold)

Premium Calculation Based on Utilization

If :

If :

When pool utilization exceeds optimal levels, premiums increase exponentially to incentivize additional liquidity provision and manage risk exposure.

Implied Volatility Calculation

Daily Return Calculation

Calculate the daily return of an asset where is the close price at day :

Statistical Measures

Mean of Daily Returns:

Variance of Daily Returns:

Standard Deviation (Sigma):

Annualized Volatility (Implied Volatility)

This calculation converts daily volatility to annualized terms, which is the standard format for option pricing models.

Step 1: Collected Fees from Liquidity Provision

In order to calculate the fees collected from a Uniswap LP position, we consider the total liquidity amount deployed at a given tick.

We have the following:

-

Total fees accumulated:

Where feeRate is the percentage fee that spot traders on Uniswap pay when they execute a trade.

-

Fraction of those fees that goes to that LP position of size positionSize:

Here, the position size corresponds to the amount of liquidity a liquidity provider (LP) allocates within a specific price range in the liquidity pool.

-

Finally, we get:

Step 2: Cumulative Premia Using Theta

The cumulative premia is the integral of theta over the asset's price path :

Where theta () for an option (assuming a zero interest rate and no dividends) is given by:

Note that is the time to expiry in traditional finance, whereas we replace it with in DeFi, representing the time spent in range by an LP position.

Step 3: Approximating Theta Using The Dirac Distribution

The Dirac Distribution

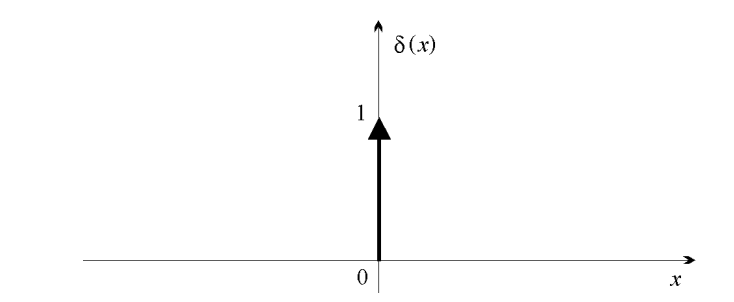

The Dirac function, denoted by , is a "pseudo-function" that has the following characteristics:

and

The graph of can therefore be represented by the entire x-axis and the positive half of the y-axis. With the "Dirac" , we aim to represent an impulse or (infinitely short) point event with finite, non-zero "energy".

Figure 1: Graph of the Dirac distribution .

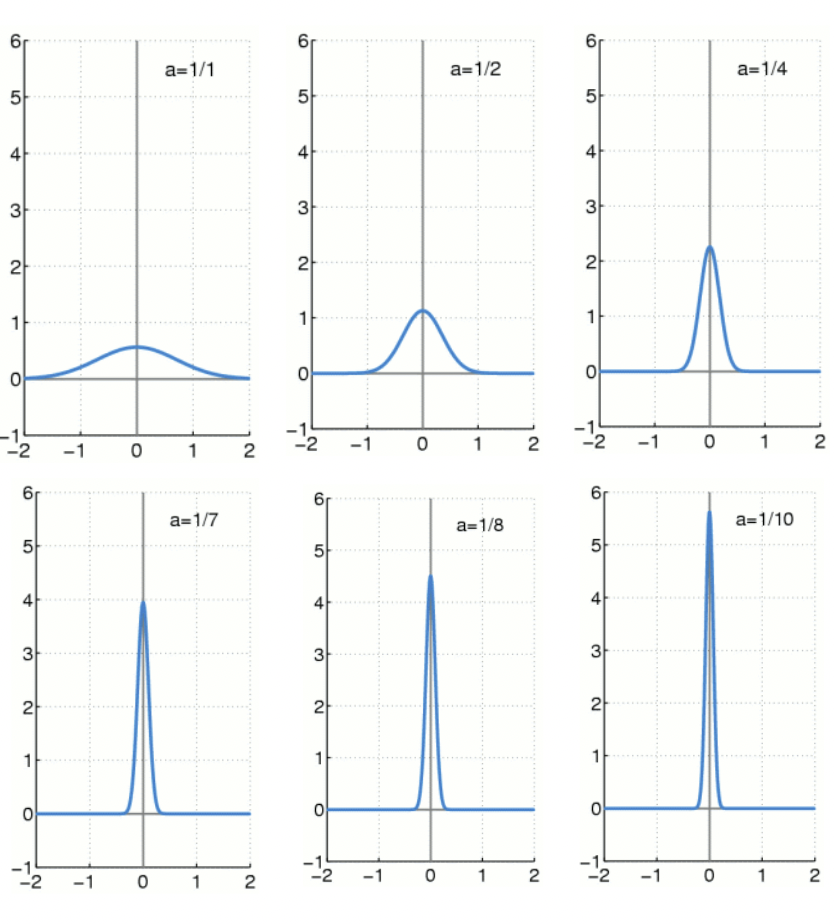

Important Definition/Theorem (See Appendix 3.2): The Dirac function can also be perceived as the limit, as tends to 0, of the following centered Gaussian function:

Figure 2: Approximation of the Dirac delta function using different zero-centered normal distributions.

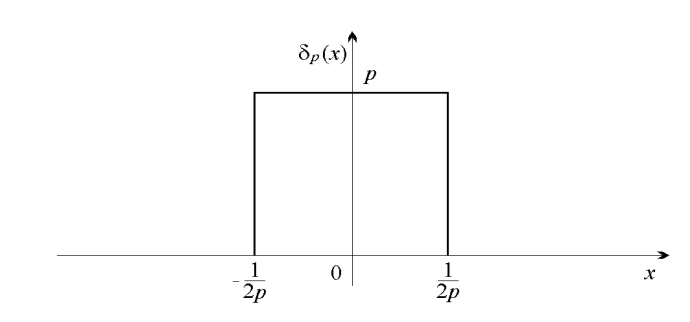

Example: One function commonly used to represent a Dirac delta function is , where:

Figure 3: Example of Dirac delta function: Graph of the function

Comparing the Dirac Function to Theta

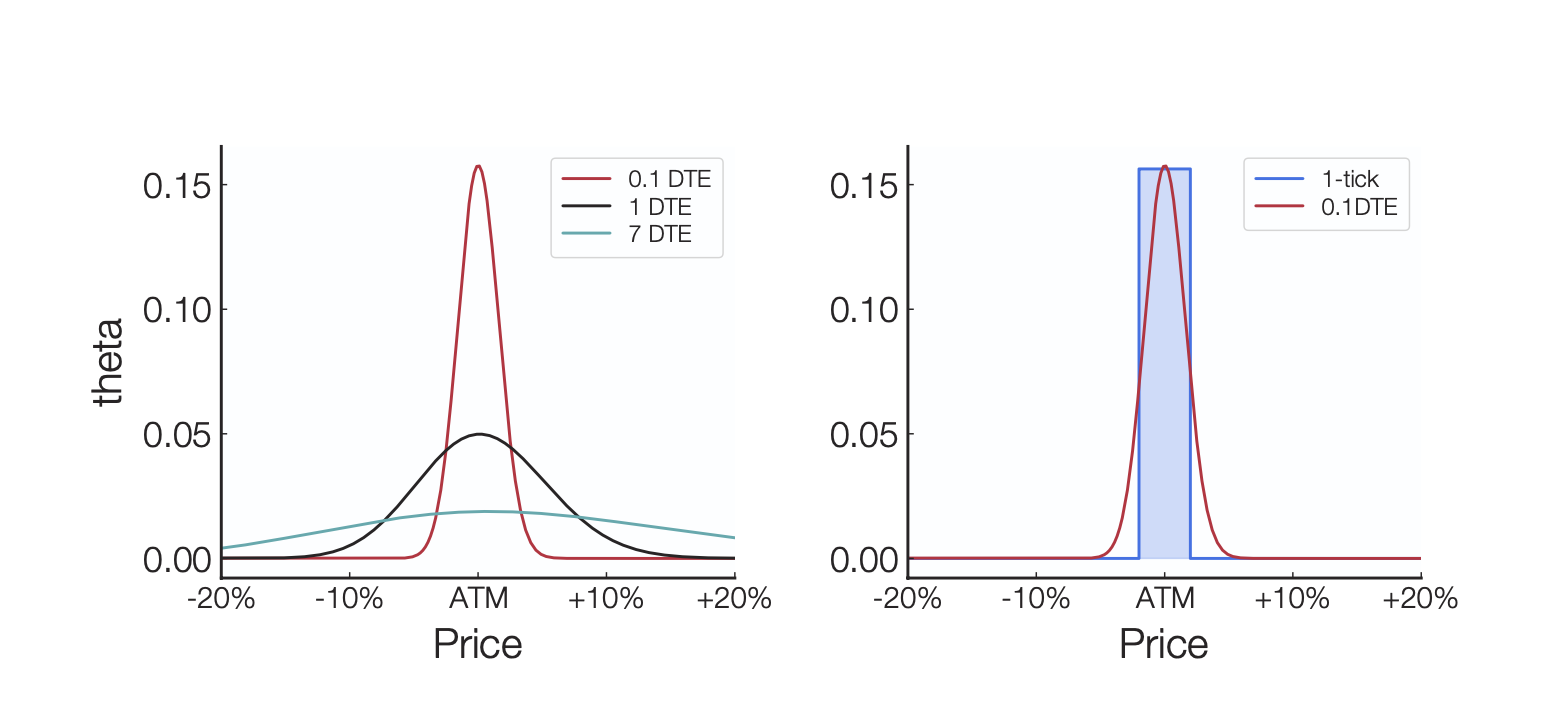

We aim to approximate the theta function of options by using an approximation of the Dirac function. The Dirac function increasingly resembles the theta function for options as the days to expiration (DTE) approaches 0. The figure below shows the theta of an option as a function of spot price movements for various DTEs: 7 DTE, 1 DTE, and 0.1 DTE.

Figure 4: Graph illustrating the variations in theta across different days until expiration.

Important Remark: The red curve is the theta of a 0.1 DTE traditional option. As being the time to expiry approaches zero, theta sharpens into a narrow peak which seems to converge towards a Dirac delta function (the rectangle in the example above), i.e. where is to be found.

To understand how this theta can have a limit resembling a Dirac delta function as , we analyze the components of the two expressions: the theta function and the Dirac delta function:

-

The Dirac delta function, , is defined such that:

-

The given equation for theta is:

-

We have

-

Set and . Then,

-

Setting the limit: As , the function approximates a Dirac delta function centered at as seen in Figure 4:

-

We need to make sure that this resulting limit is a Dirac delta function, in other words, it respects the two conditions of the definition of the Dirac delta function:

a) At , we have that and elsewhere the function equals 0.

b) To compute the integral of the expression over the entire real line , we utilize the sifting property of the delta function. This property states that for any function that is continuous at ,

Applying this property to the expression , where , we have:

Conclusion: is a Dirac delta function scaled by .

-

Now, we'll assume that the theta function converges to a Dirac delta that is similar to a rectangle (as seen in Figure 4). Hence, let's determine the optimal Dirac delta function by finding the best in the equation:

Important consequence: The area under both functions, the theta function and the Dirac delta function, are approximately equal, and we proceed to the following calculations:

Keep in mind that the minimum width of the Dirac delta function is intrinsically tied to the tick spacing of a Uniswap v3 pool.

| Fee Tier | Tick Spacing | Description |

|---|---|---|

| 1 bp | 1 | LP positions can be created with lower and upper prices and , respectively, that can be set at any multiple of 1.0001. |

| 5 bps | 10 | LP positions can be created with lower and upper prices and at any multiple of 1.0010. |

| 30 bps | 60 | LP positions can be created with lower and upper prices and at any multiple of 1.0060. |

| 100 bps | 200 | LP positions can be created with lower and upper prices and at any multiple of 1.0200. |

Table 1: Uniswap v3 Pool Tick Spacing and LP Position Ranges

Our objective is to achieve the narrowest width possible, which equates to the smallest range of an LP position, dictated by the pool's tick spacing. Given and as the lower and upper bounds of our range, respectively, and considering the width , it is helpful to use the following transformation to effectively apply Taylor's expansion:

Where is the geometric mean of the LP position's price range or alternatively the strike price of the corresponding option and is the range factor, a measure of width, of the LP position.

This allows us to express the width of an LP position as:

Remark: We take to represent an extremely narrow LP position, mimicking an option near expiry. We note, however, that the Uniswap v3 smart contracts limit the minimum width to the pool's tick spacing .

Given that where is the tick for the upper price, we can further simplify the expression:

Here, represents the difference between the ticks for the upper and lower prices. This transformation provides a more useful formulation for our width.

With this newly formulated expression for the width of an extremely narrow LP position, we can find the approximating Dirac function to approximate theta and the cumulative premium of a corresponding option.

- The area under the theta function is approximately (see Appendix below 3.1).

- The width of the theta function is .

- The height of the theta function is:

Therefore, .

Theta is approximated as the height of the approximating Dirac delta function multiplied by the time spent in range. Thus, the cumulative premia is:

Step 4: Derive the Implied Volatility (IV)

Equating Premia with Fees: We assert that the accumulated streaming premia (theoretical) of an option is equal to that of the fees collected from liquidity provision (actual). This aligns with our observation that LP positions behave similarly to options, and hence, their premia received is simply the fees collected by the position. By equating premia with collected fees we have:

We substitute and obtain:

Assumptions:

- The relationship between the tick spacing and the fee rate is as follows: In fact, tick spacings are 200 for 1% fee rate, 60 for 0.3%, 10 for 0.05% as seen in Table 1.

- The premia is calculated for one options contract, which corresponds to a position size of in terms of the quote asset.

- The LP position is centered around the current spot price, so the spot price is equal to its strike price .

With the above assumptions, this simplifies further:

Finally, we solve for , the implied volatility:

This formula provides the implied volatility derived from market activity, allowing the protocol to price positions based on actual trading data rather than external oracle feeds.

Implementation Summary

The pricing framework combines several key components:

- Black-Scholes adaptation for crypto assets with zero risk-free rate

- Pool utilization optimization to reflect market dynamics

- Implied volatility calculation from historical price data

- Theta approximation using Dirac distributions for LP positions

This comprehensive approach ensures that pricing accurately reflects both theoretical option values and practical market conditions in decentralized finance environments.