Timelock Swap

Permissionless Uniswap V4 AMM with hooks. The unified liquidity layer of the Timelock Ecosystem.

Introduction

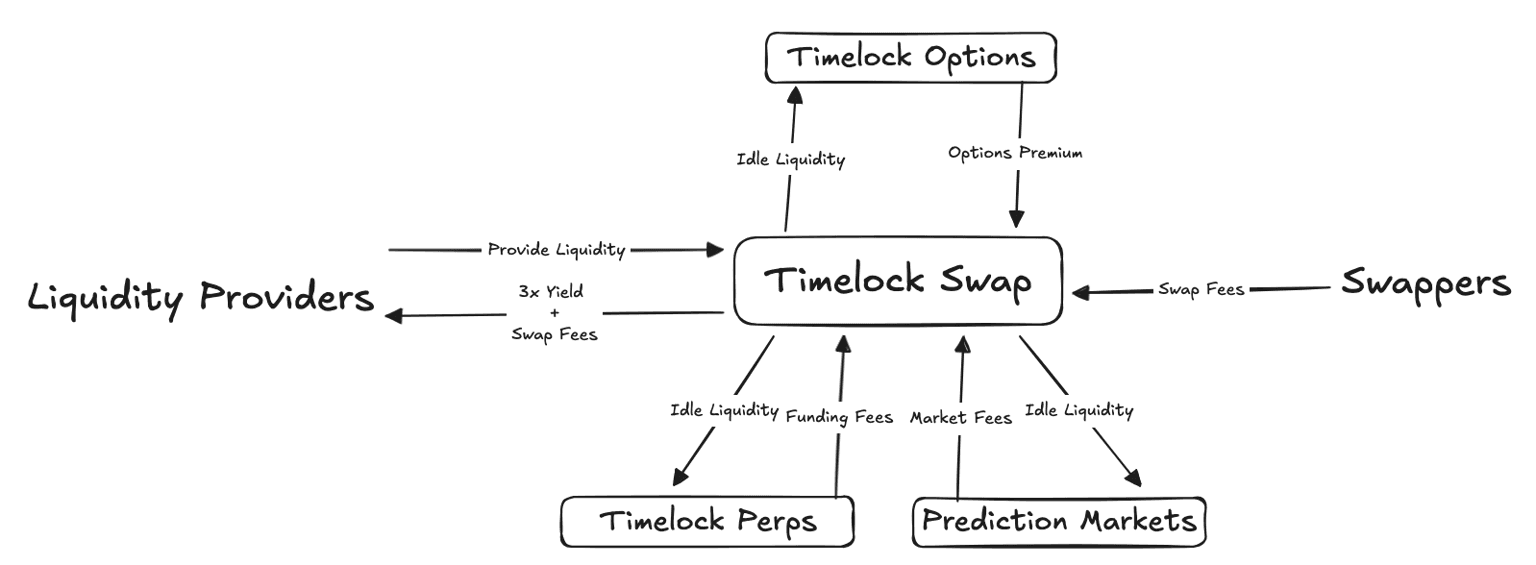

Timelock Swap is the unified liquidity layer of the Timelock Protocol ecosystem. Built on Uniswap V4 with hooks, it optimizes how liquidity is deployed and reused across perps, options, and prediction markets.

Timelock Swap enables permissionless markets for any ERC20 token on any EVM chain: spot, perps, and options for 5000+ altcoins, RWAs, onchain equities, and more.

Core Features

Uniswap V4 Hooks

Maximizes capital efficiency, minimizes costs, and enables sophisticated liquidity provisioning.

Permissionless Markets

Permissionless market creation for any ERC20 token. Anyone can supply liquidity; spot, perps, options, and prediction markets go live instantly.

Unified Liquidity

A single pool of liquidity powers swaps, perps, options, and prediction markets. LPs capture yield across all venues from one pool, improving capital efficiency.

Risk-Neutral LPs

Idle tick liquidity is borrowed for perps and options in a way that is risk-neutral to LPs. Earn higher yields without additional risk or counterparty exposure to trader PnL.

Liquidity Vaults

Liquidity providers make a 1-click USDC deposit into vaults managed by Timelock AI agents, Charm.fi, and market makers (e.g. Re7, STS Digital).

Passive yield for LPs. No rebalancing, range selection, or active monitoring.

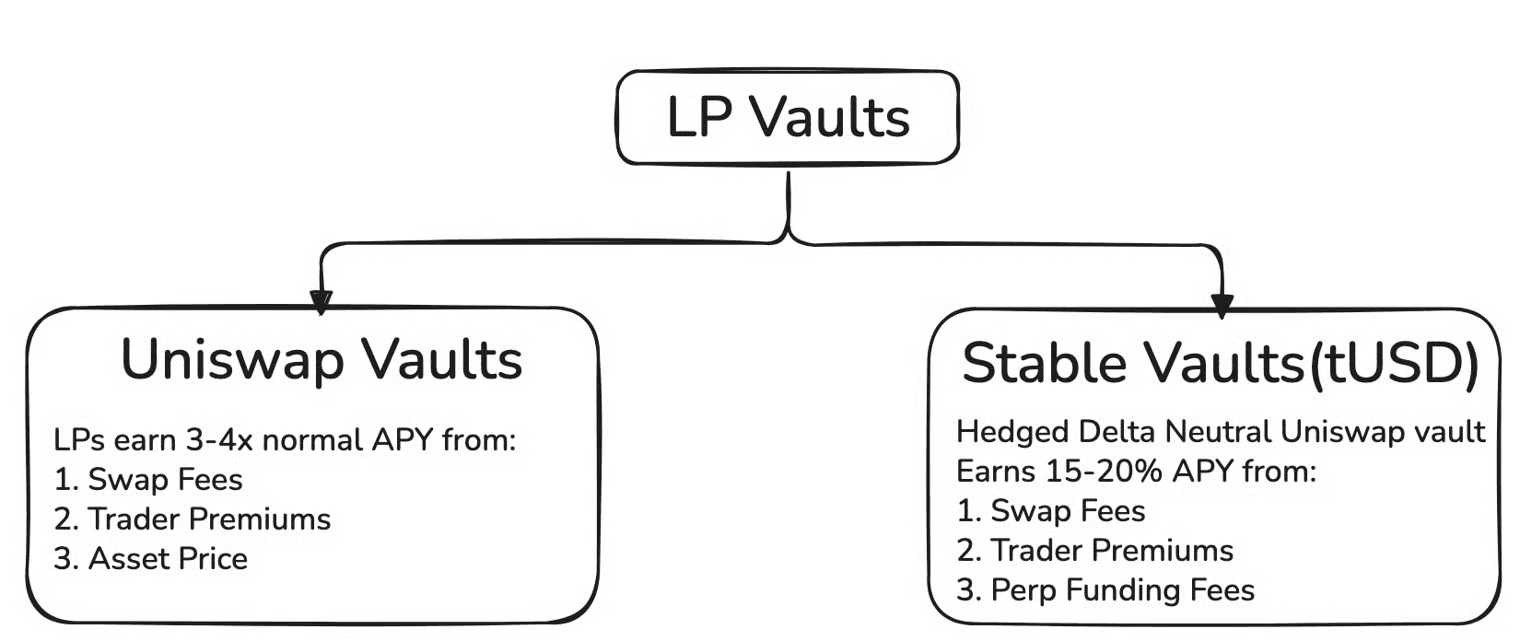

Timelock offers two vault types to match different risk profiles:

Uniswap Vaults

- Projects seeding liquidity for perps, options, and prediction markets.

- LPs bullish on a token who want extra risk-neutral yield on it.

- Tokens launched through Timelock Launchpad.

- Uniswap LPs seeking extra yield on existing positions with the same risk profile.

Stable Vaults (tUSD)

- Family offices, whales, large funds, or retail seeking high yield on stablecoins. bu