Architecture

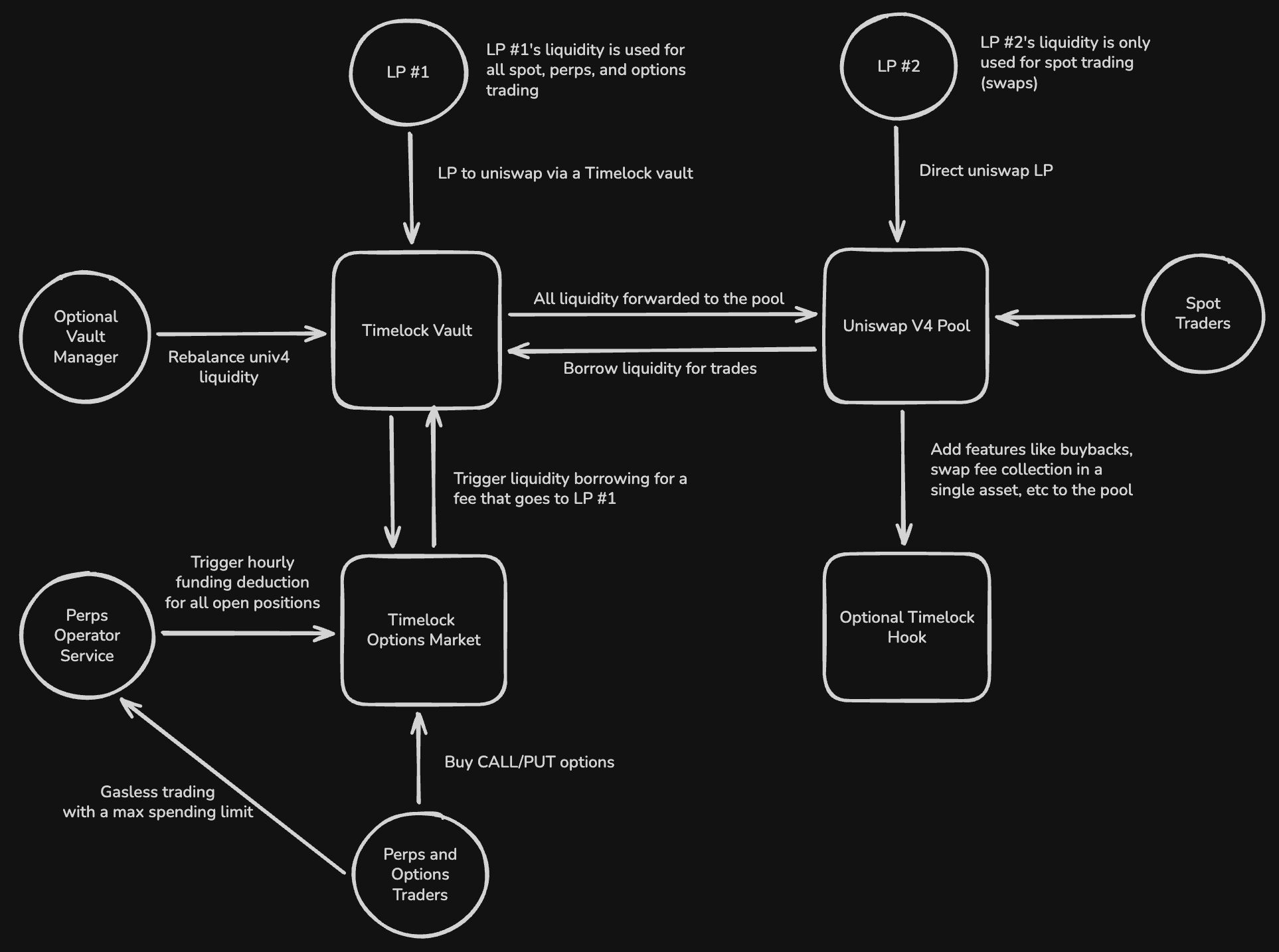

System architecture and liquidity flow in the Timelock protocol.

Timelock enables permissionless perps, options, and spot trading through a single Uniswap V4 pool with sophisticated liquidity management.

Core Components

Timelock Vault

The vault is the liquidity management layer that bridges LPs and the Uniswap V4 pool:

- Accepts LP deposits and forwards liquidity to the Uniswap V4 pool.

- Borrows idle tick liquidity from the pool to collateralize perps and options.

- Ensures borrowed liquidity is risk-neutral to LPs.

- Optional: integrates with Vault Manager for automated rebalancing.

Borrowed Liquidity follows the exact same payoff as uniswap IL, making it completely risk-neutral apart from the uniswap LP risks.

Uniswap V4 Pool

The unified liquidity layer that powers all trading activity:

- Executes spot swaps for traders.

- Provides liquidity for perps and options via the Timelock Vault.

- Collects swap fees, perp funding, and option premia.

- Returns fees to vault depositors and direct LPs.

Timelock Options Market

Enables oracle-free options trading:

- Traders purchase ATM everlasting options.

- Premium paid via streaming theta (continuous funding).

- Liquidity borrowed from vault to collateralize option payoffs.

- Pricing derived from pool implied volatility (IV).

Options trigger liquidity borrowing, which generates a fee stream back to vault LPs.

Optional Components

Perps Operator Service

- Triggers hourly funding deduction for all open positions.

- Allows gasless trading on the dApp via an API.

- Allows users to specify a max spending limit for the total funding they can be charged.

Vault Managers

- Automated liquidity rebalancing for concentrated positions.

- Optimizes tick ranges based on market conditions.

- Maximizes fee capture for vault depositors.

Timelock Hook

- Uniswap V4 hook for enhanced pool functionality.

- Enables features like buybacks, single-asset fee collection, and custom trading logic.

- Composable with other protocols.

Liquidity Flow

Spot Trading Flow

- Spot Traders swap tokens directly in the Uniswap V4 pool.

- Pool charges swap fees based on the fee tier.

- Fees distributed to LP #1 (via vault) and LP #2 (direct).

Perps & Options Trading Flow

- Perps/Options Traders open positions via Timelock Options Market.

- Vault borrows liquidity from the Uniswap V4 pool to collateralize the position.

- Trader pays funding (streaming theta) to keep the position open.

- Funding flows back to LP #1 depositors as additional yield.

- On position close, borrowed liquidity is returned to the pool.

Risk Management

The vault ensures all positions are fully collateralized:

- Perps: Spot asset borrowed and escrowed to back the derivative.

- Options: Strike amount borrowed, eliminating liquidation risk.

- LPs: Protected from trader PnL; earn fees regardless of trade outcomes.

Liquidity is only borrowed from idle ticks, ensuring spot trading remains unaffected and LPs maintain delta-neutral exposure.

Key Design Principles

- Unified Liquidity: One pool serves spot, perps, and options, maximizing capital efficiency.

- Oracle-Free: Pricing derived from Uniswap market data and implied volatility.

- Permissionless: Anyone can create markets by supplying liquidity.

- Risk-Neutral LPs: Vault borrowing design ensures LPs are not exposed to trader PnL.

- No Liquidations: Fully collateralized positions eliminate liquidation risk for traders.

This architecture enables Timelock to deliver liquidation-free leverage and permissionless derivatives while maintaining LP safety and capital efficiency across all trading venues.