Mechanism Design

How Timelock achieves no-liquidation perps using UniswapV4

Mechanism Design

Timelock Perps deliver a no-loss, no-liquidation payoff: traders capture unlimited upside while downside is strictly limited to funding fees already paid.

No margin deposit, no wallet abstraction, no forced closures. Just continuous hourly funding, paid directly from your wallet.

You pay to hold exposure indefinitely, like theta decay on an option, but wrapped in a simple perp UX (similar to Hyperliquid or Lighter) without the liquidation risk.

Imagine trading perps where you keep the entire upside but take no loss and never get liquidated. You just pay funding until you choose to close.

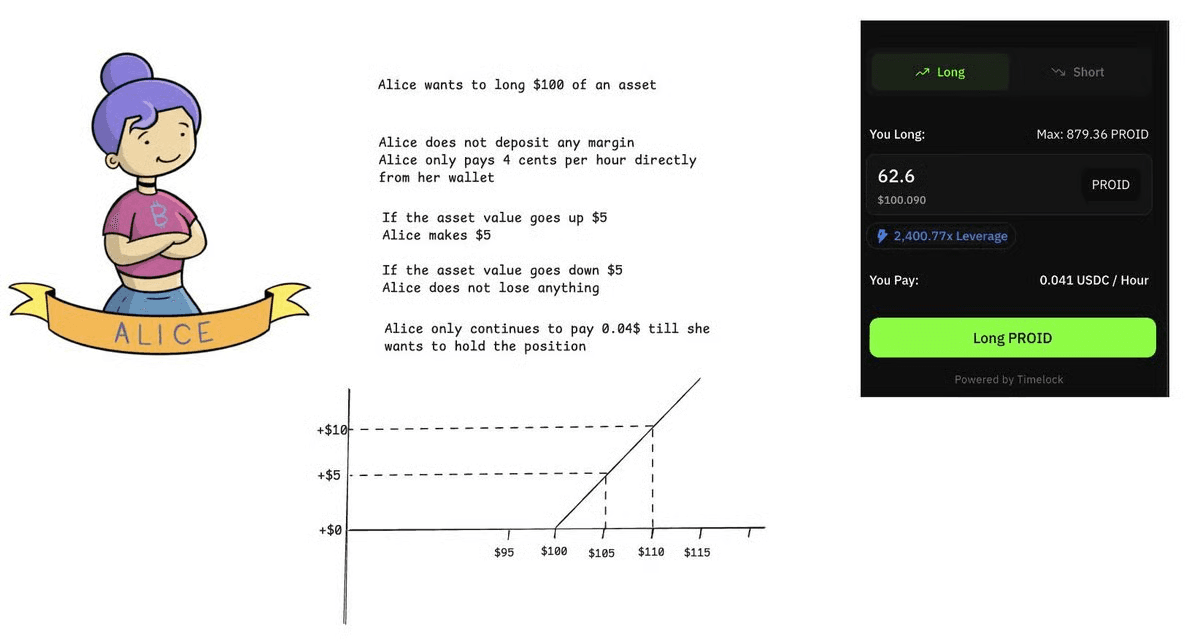

Understanding the Payoff: Alice's Example

To understand the payoff, consider Alice trading a No-Loss Perp:

- Alice longs $100 worth of token.

- She pays $0.04 funding every hour.

- She keeps the entire upside if the token goes up.

- She loses nothing if the token goes down.

- She keeps paying $0.04 funding until she wants to keep her position open.

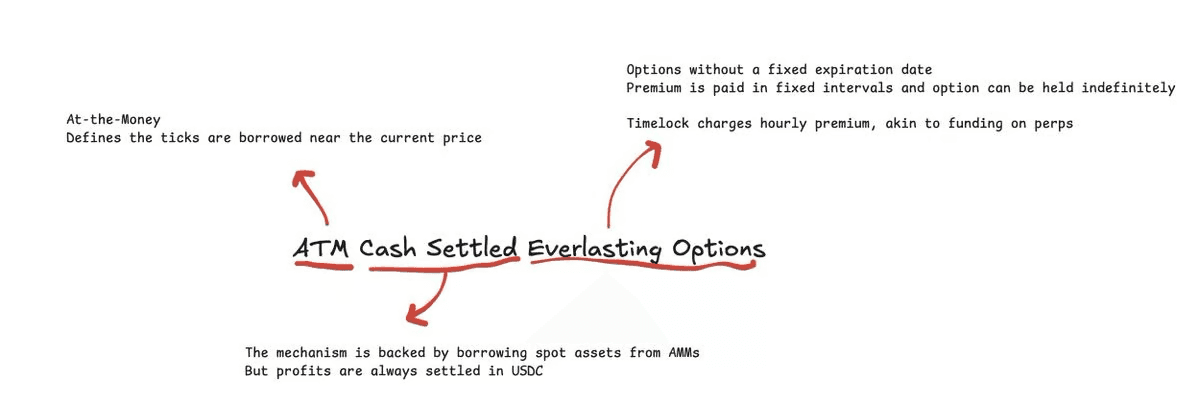

Options as Perps

For the options-savvy reader: Timelock Perps are essentially an ATM Cash-Settled Everlasting European Call/Put Option (see Paradigm's Everlasting Options paper). Timelock abstracts away option complexity (strike, premium, expiry) into retail-friendly layer with simple. perp-like UX. So retail trades it like perps on Hyperliquid or Lighter, but with No liquidations and:

- No upfront premium.

- No expiry or rolling.

- Perp Funding ≈ Option premium

- Full delta exposure (100% upside capture)

- Downside capped at cumulative funding paid

This eliminates liquidation engines, oracles, and margin calls while preserving perp-like trading.

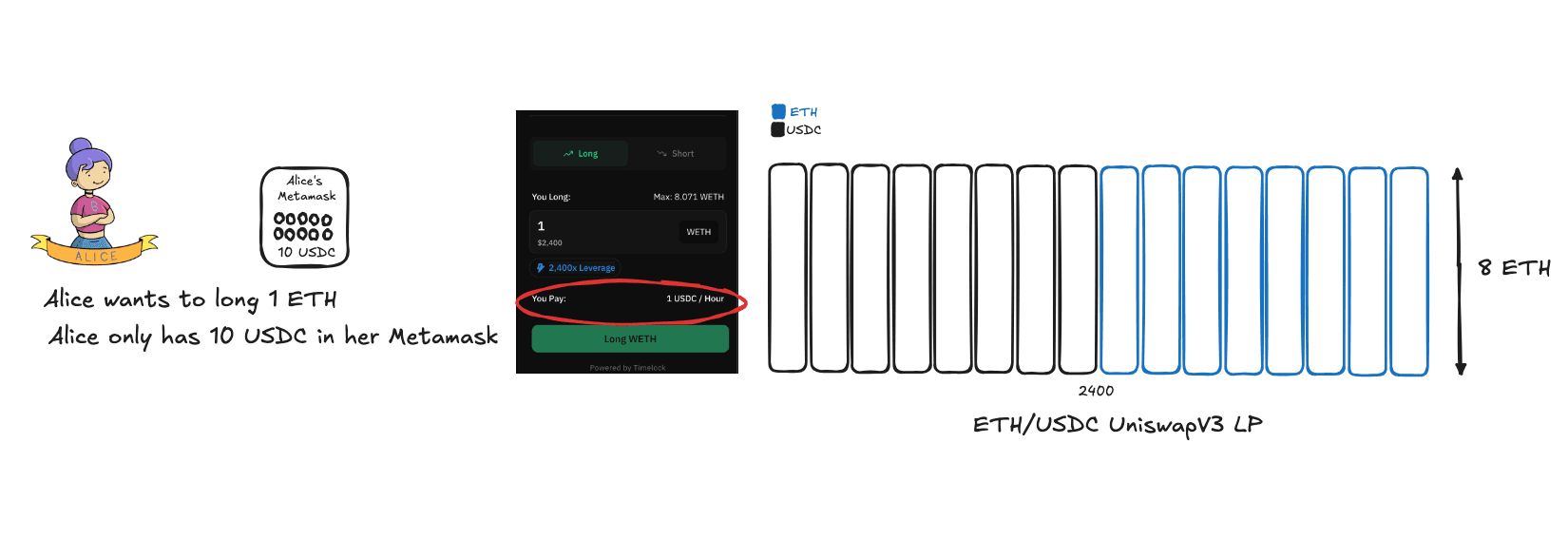

Trade Example

Alice wants to long 1 ETH at 2400 USDC but has only 10 USDC in her wallet.

-

On a CLOB perps DEX (Hyperliquid, Lighter, Aster), at 240x leverage would face liquidation risk at just $10 price movement in ETH.

-

On Timelock, she opens a 1 ETH No-Loss Perps long with no liquidation risk.

Here's an example where Alice turns 10 USDC into a 120x return.

Funding Calculation & Effective Leverage

Assume ETH = 2400, IV = 50%. Funding for this trade is 1 USDC per hour. (How? Pricing Docs)

- 1 USDC for 1 hour of exposure to 2400 USDC notional ≈ 2400x effective leverage.

- 10 USDC for 10 hours on the same notional ≈ 240x effective leverage.

Alice can top up USDC in her wallet anytime to extend the trade.

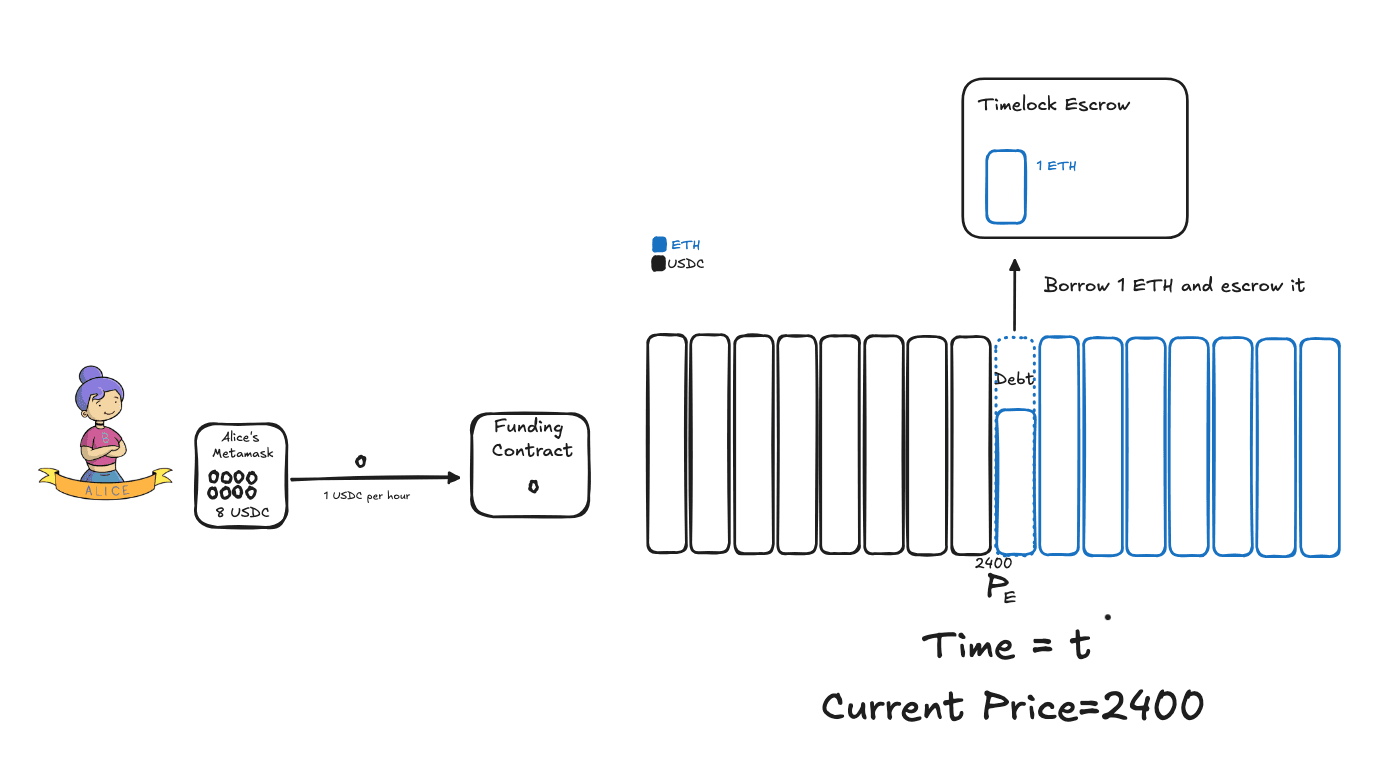

How It Works

To open a 1 ETH long at t, price = 2400:

- Timelock borrows 1 ETH and escrows it.

- Timelock deducts 1 USDC per hour from Alice's wallet.

After 1 hour, Alice has paid only 1 USDC → 2400x leverage. No margin deposited.

- Price up → Alice captures all of the upside.

- Price down → Alice loses no more than the 1 USDC she's paid so far.

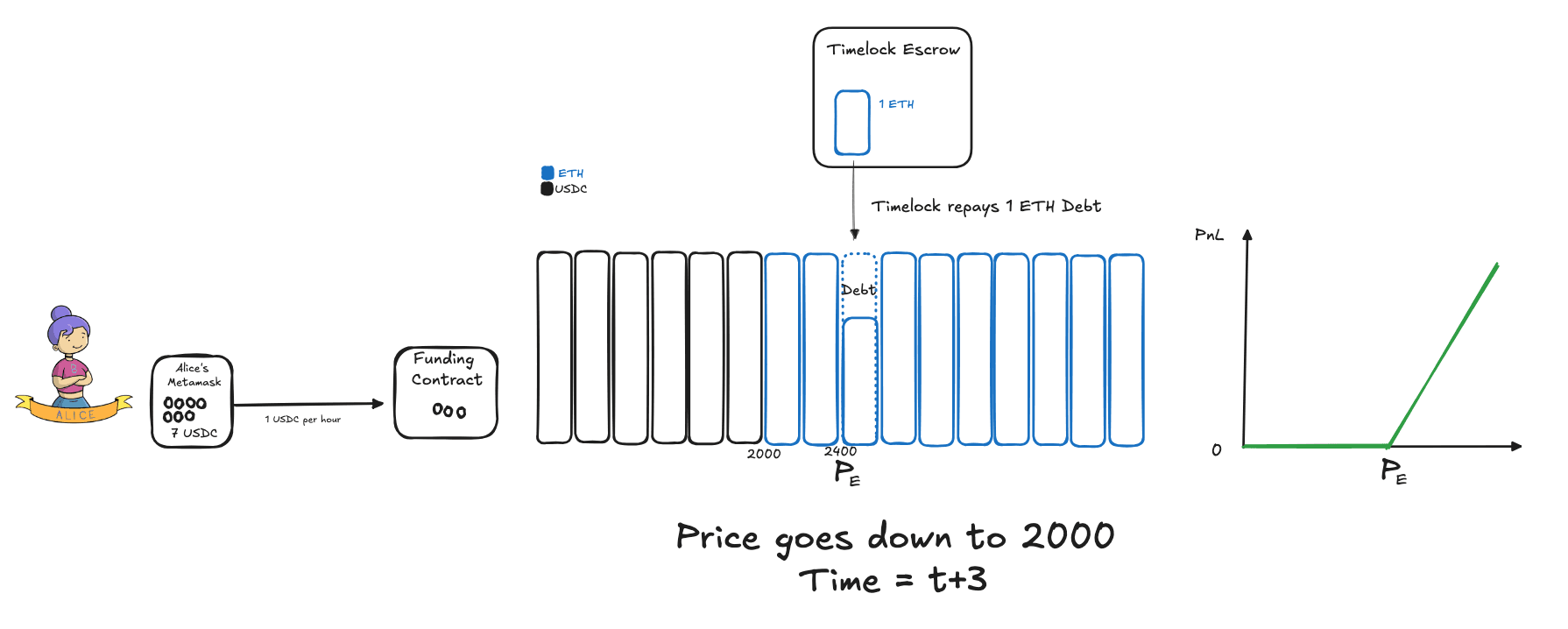

Downside Scenario: Price Drops to 2000

At t + 3h, ETH trades at 2000:

- Alice has paid 3 USDC in funding so far.

- On Hyperliquid, she'd have lost 400 USDC or been liquidated.

- On Timelock, her max loss is the 3 USDC already paid. The position stays open. No liquidation.

Why?

- Timelock positions are fully collateralized, backed by spot ETH borrowed from Uniswap.

- On Hyperliquid, she holds a P2P derivative against a market maker, not real ETH.

- Debt is in ETH, held in Timelock Escrow. Escrow ≥ repay amount → no forced closure or liquidation.

- To close, Timelock repays 1 ETH to the LP and makes them whole.

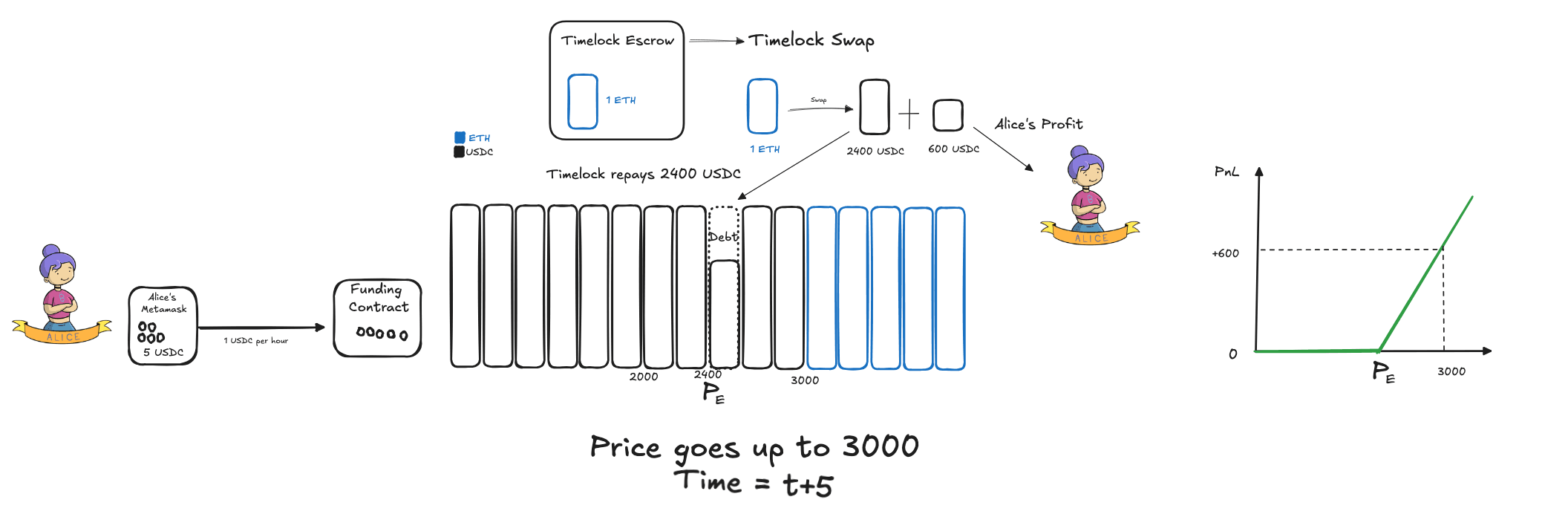

Upside Scenario: Price Rallies to 3000

At t + 5h, ETH trades at 3000 and Alice closes:

- She has paid 5 USDC funding over 5 hours.

- Timelock Escrow holds 1 ETH, now worth 3000 USDC.

Protocol flow:

- Swap 1 ETH → USDC on Timelock Swap (≈3000 USDC).

- Repay 2400 USDC to the LP.

- 600 USDC → Alice as profit.

Result

- Alice paid 5 USDC total funding.

- Alice receives 600 USDC profit → 120x return on the 5 USDC she spent.

- Downside was always capped at funding paid. No margin deposit, no liquidation risk.

- Her position was never at a loss or at risk of closure, even when the implied loss exceeded her wallet or funding paid.