Mechanism Design

How Timelock utilizes UniswapV4 hooks and enables novel features for launched tokens

Mechanism Design

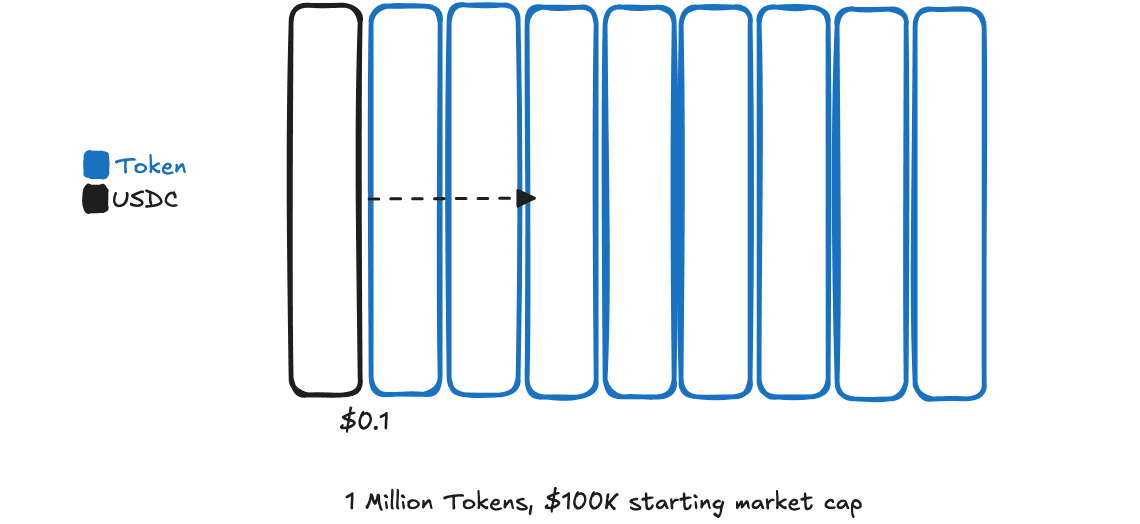

Token Launch

All tokens start as single-sided Uniswap V4 (Timelock Swap) Token/USDC pools. At market creation, 1M tokens are minted and deposited into a single-sided LP at 0.1 USDC per token: a 100K USDC starting market cap.

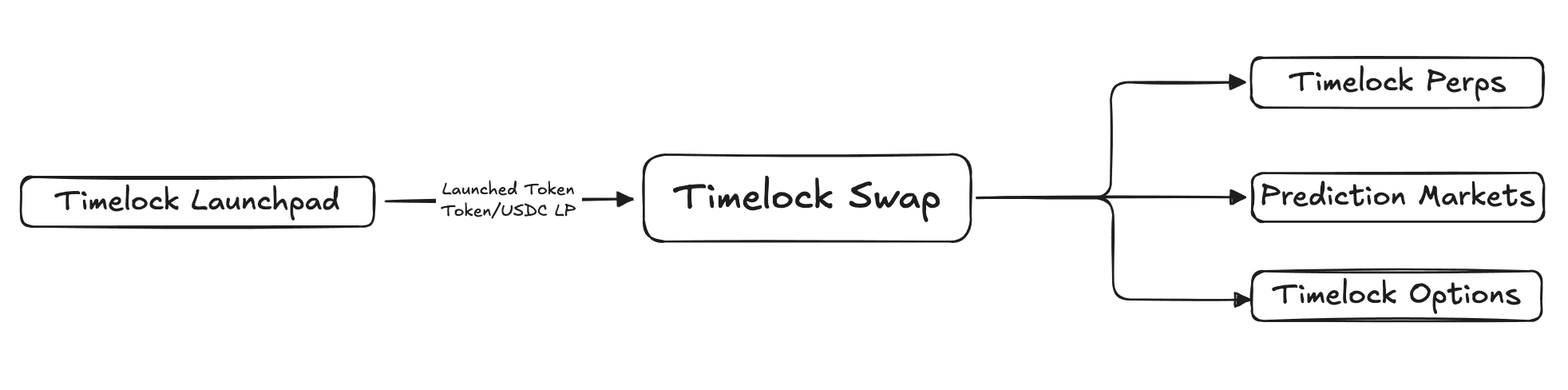

Spot, Perps and Options

Tokens begin on Timelock Swap and are natively eligible for spot, Timelock Perps, Options, and Prediction Markets from Day Zero.

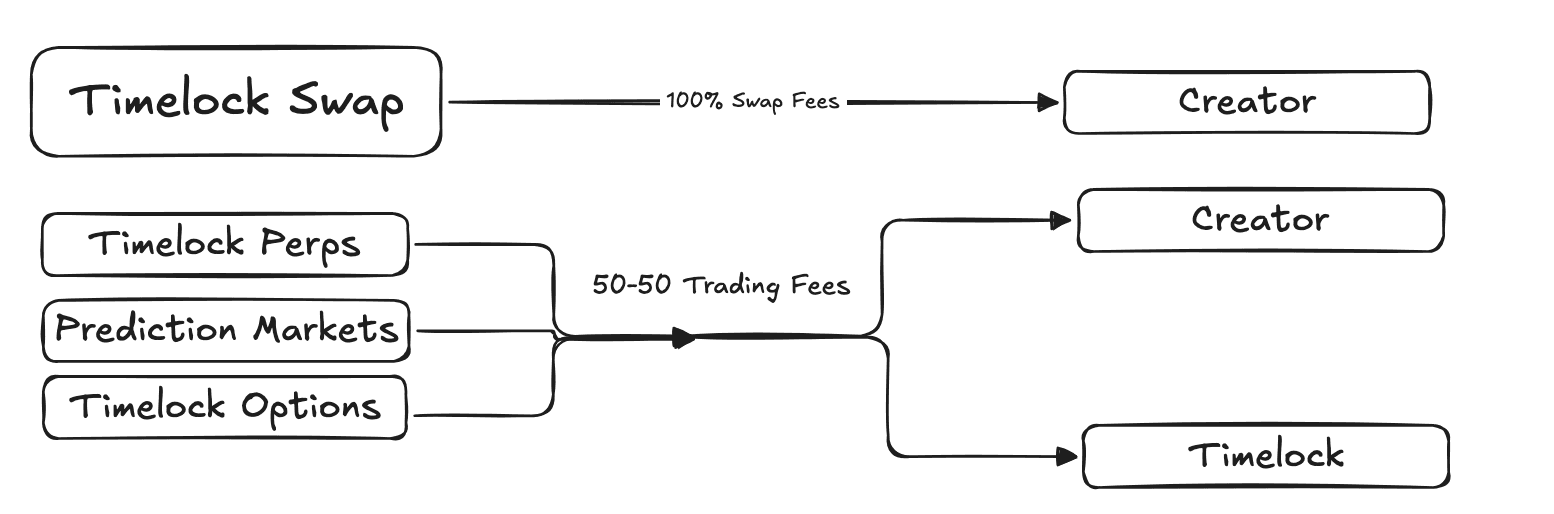

Revenue Share

Timelock Launchpad routes real revenue to creators to reward and grow the community. Uniswap V4 hooks collect all swap fees in USDC (not token) and all trading fees in USDC.

Distribution to the creator, in perpetuity:

- 100% of swap fees

- 50% of trading fees from perps and options

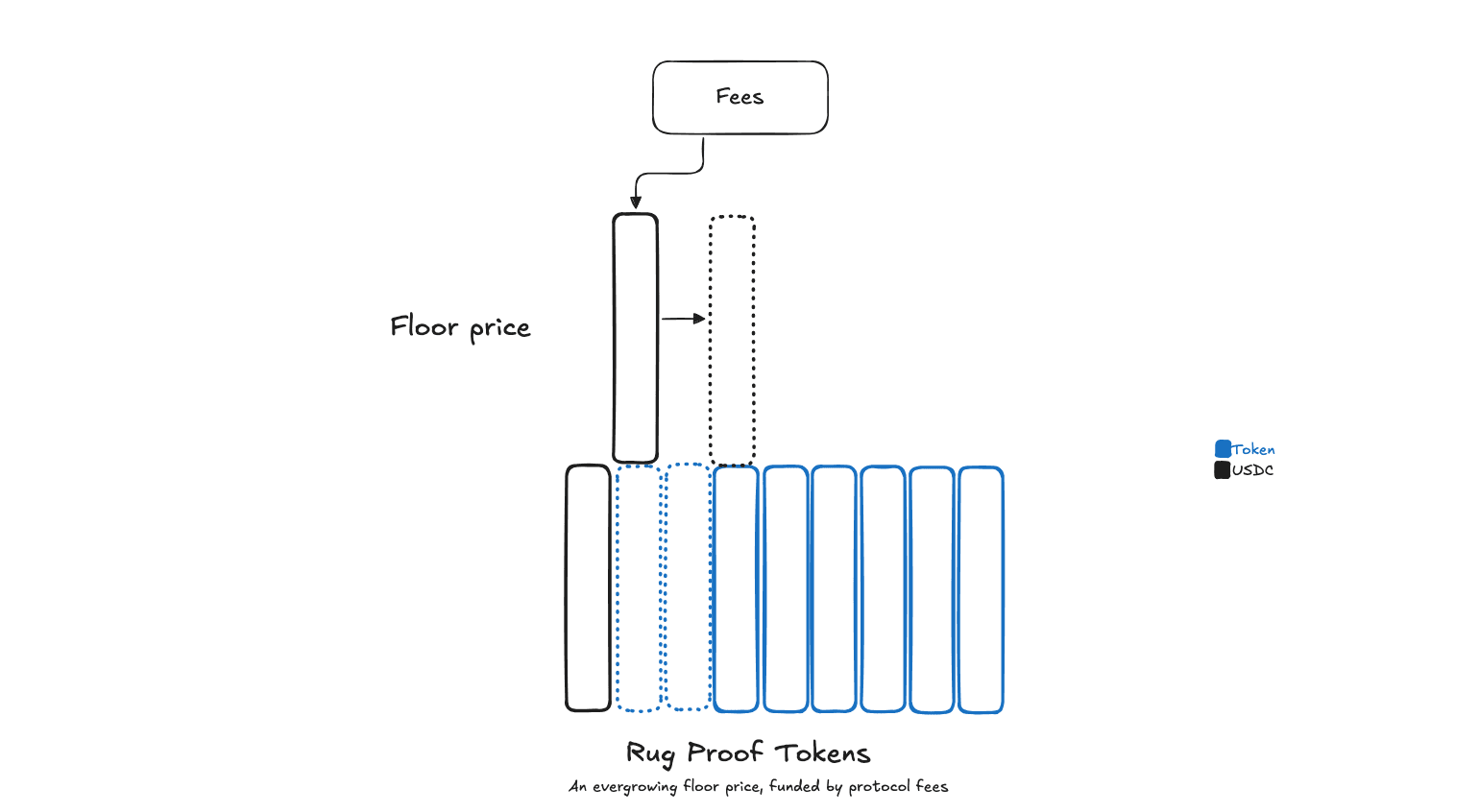

Automated Buybacks

Swap and trading fee revenue automatically buys back the token once a threshold is reached. That creates perpetual buy pressure; price rises organically as the community trades.

Token Floor Price

Uniswap V4 hooks deploy single-sided USDC liquidity to absorb token supply, establishing an ever-growing floor price below which the token never falls. Swap and trading fees continuously fund it. Rug-proof tokens.